Ten years ago, I discussed how smartphones made recording conversations easier for employees.

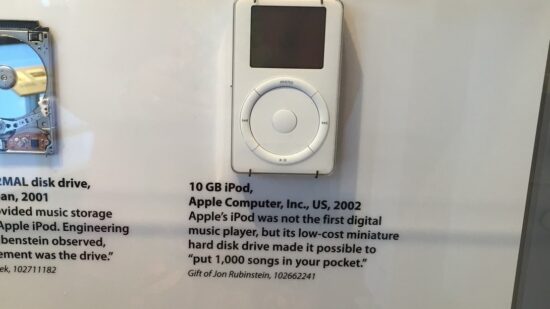

That post seems quaint compared to today’s technology—like that iPod I saw in a museum (and pictured here).

Now employers need to worry about devices like Plaud—sleek call recorders and AI note-takers—and Ray‑Ban Meta glasses, which record audio and video